|

Tweet

|

|

|

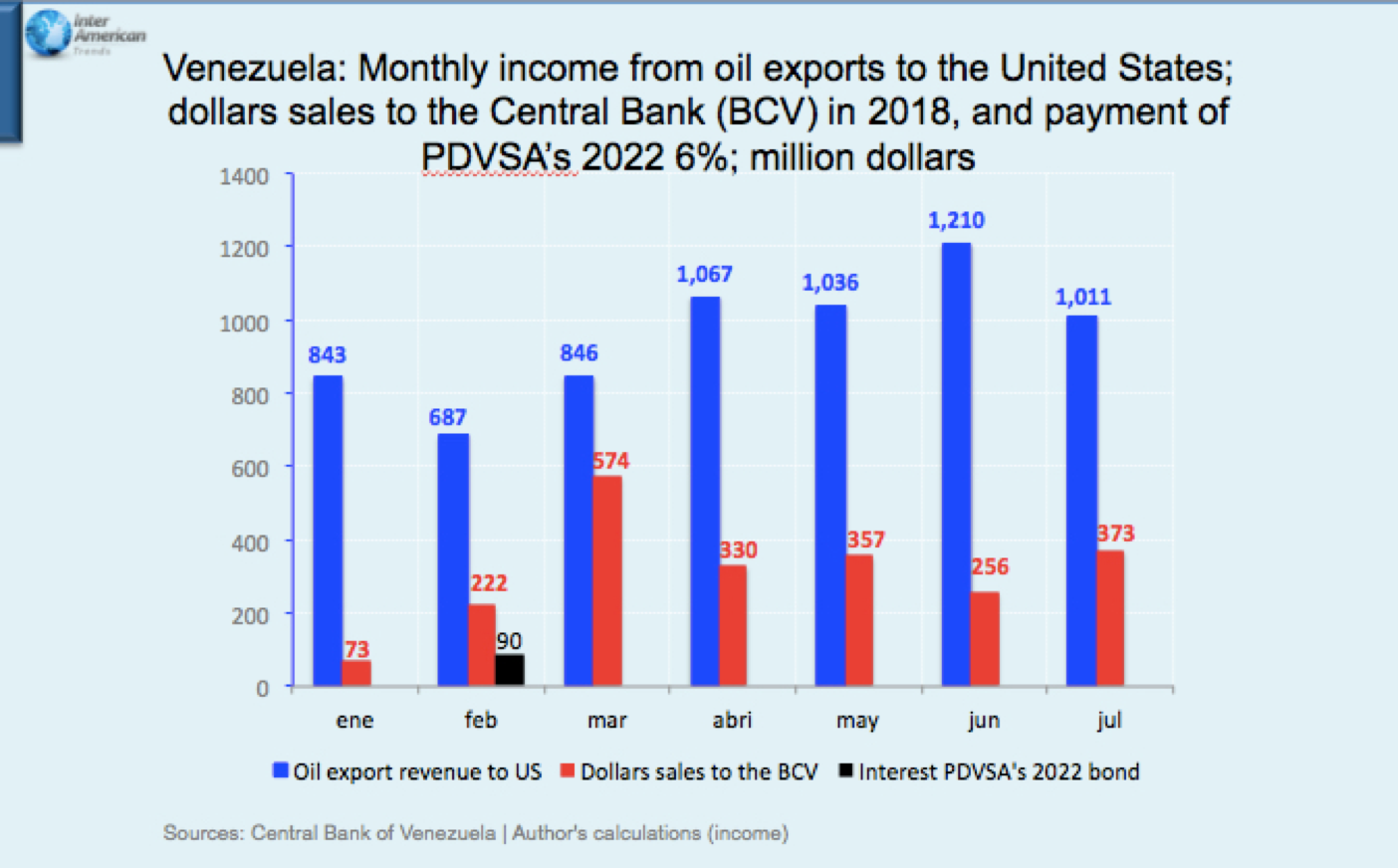

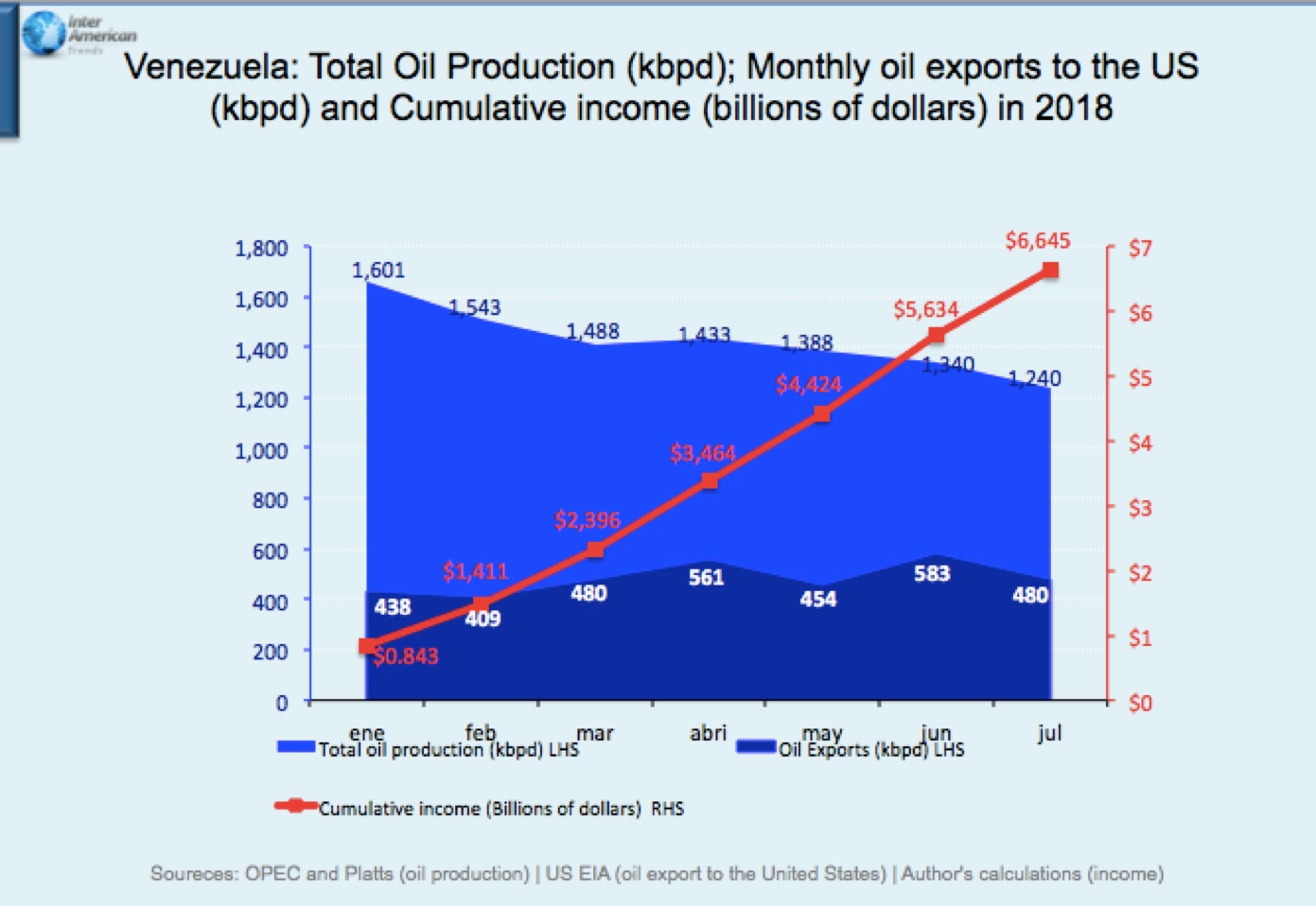

The regime of Nicolas Maduro opted to increase oil sales to the United States in 2018, despite the 23 percent drop in oil crude production in the first seven months of the year. That fall in production meant a collapse of 361 thousand barrels per day, using data from the Platts agency for July and OPEC's secondary sources for the first half of 2018. However, Maduro increased exports to US refineries in the Gulf of Mexico in 10 percent, 42 thousand barrels per day (kbpd), compared to the volume sent in January of this year. Likewise, Maduro increased by 47 percent the purchase of refined petroleum products from the United States to satisfy the domestic market and to mix with the extra-heavy petroleum from the Orinoco Oil Belt. That is, the fall in the production of light crudes and from refineries (Paraguaná, Bajo Grande, El Palito, and Puerto La Cruz) has been offset by the 124 kbpd imported from the American refineries during the first five months of 2018, according to the United States Energy Information Administration (EIA). In 2017, oil export figures to the United States show an average fall of 280 kbpd, equivalent to 39%. Similarly, there is a collapse in total oil production of 356 kbpd for the same period, according to the OPEC's secondary sources. Therefore, the plunge of Venezuelan oil output affected crude exports to the United States, representing 76 percent of the total fall. This decision of the Maduro regime - the best market for Venezuelan oil, due to its proximity and payment terms in cash - caused the fall in incomes in dollars to PDVSA cash flow and the Central Bank of Venezuela (BCV), because oil shipments to China and the Petrocaribe countries do not generate cash flow in foreign currency. In addition, the way in which the Maduro regime was being financed by PDVSA and Sovereign bonds, and the renewal of the Chinese Fund loans, were affected in 2017 by the financial sanctions of the Trump Administration -a year ago-, and the grace period granted by Beijing (Development Bank of China) to the Venezuelan government. Therefore, the need of the Maduro regime to obtain dollars in cash, in the face of a fall in crude production, caused the policy of cutting oil exports to the United States to be changed five months ago, when PDVSA billed 687 million dollars, the lowest amount this year. From that moment, in February, the Maduro regime increased shipments of crude oil to the United States (US Empire) which once again became the largest customer of Venezuelan crude, shipping 1 billion dollars a month. This situation has allowed the Maduro regime to continue receiving a constant flow of dollars. Between January and July 2018, the accumulated amount was 6.645 billion dollars, 300 million dollars more than the corresponding value in 2017. According to Tankertrackers website, in July, Venezuela's oil exports were 995 kbpd, broken down as follows: United States 412 kbpd (41 percent); India 267 kbpd (27 percent); China 137 kbpd (14 percent); Trinidad and Tobago 56 kbpd (6 percent); Cuba 36 kbpd (4 percent); Aruba 34 kbpd (3 percent); Jamaica 33 kbpd (3 percent) and Sweden 20 kbpd (2 percent). Venezuela crude oil exports by destination confirm the change in strategy of the Maduro regime because they are exporting 79 percent to the markets that pay in cash, while sales that do not generate revenue, China, and the Petrocaribe countries, received 21 percent. The volume placed in the domestic market has also been affected. In June and July, the national refining system received 289 kbpd and 245 kbpd, respectively, which indicates that it operates at only 20 percent of its capacity. The disaster of the oil industry -in July the production of Pdvsa Western Division was 289 kbpd, the lowest since 1932- makes the Maduro regime ignore the socialist revolution ideology in order to receive dollars from oil sales to the refineries of the US Empire, putting aside allied governments of China and Petrocaribe countries, by reducing their share of crude oil exports to a minimum. Therefore, Beijing (China National Petroleum Company) is requesting the delivery of oil reserves as collateral, in the same way that Maduro proposed for the strengthening of international reserves the use of oil reserves from the Orinoco Oil Belt as an asset to the Central Bank foreign reserves. In conclusion, Maduro seeks to maintain its status quo with oil crude sales and purchases of refined products to and from the US Empire, without the slightest intention of improving the lives of most Venezuelans. |