|

Tweet

|

|

|

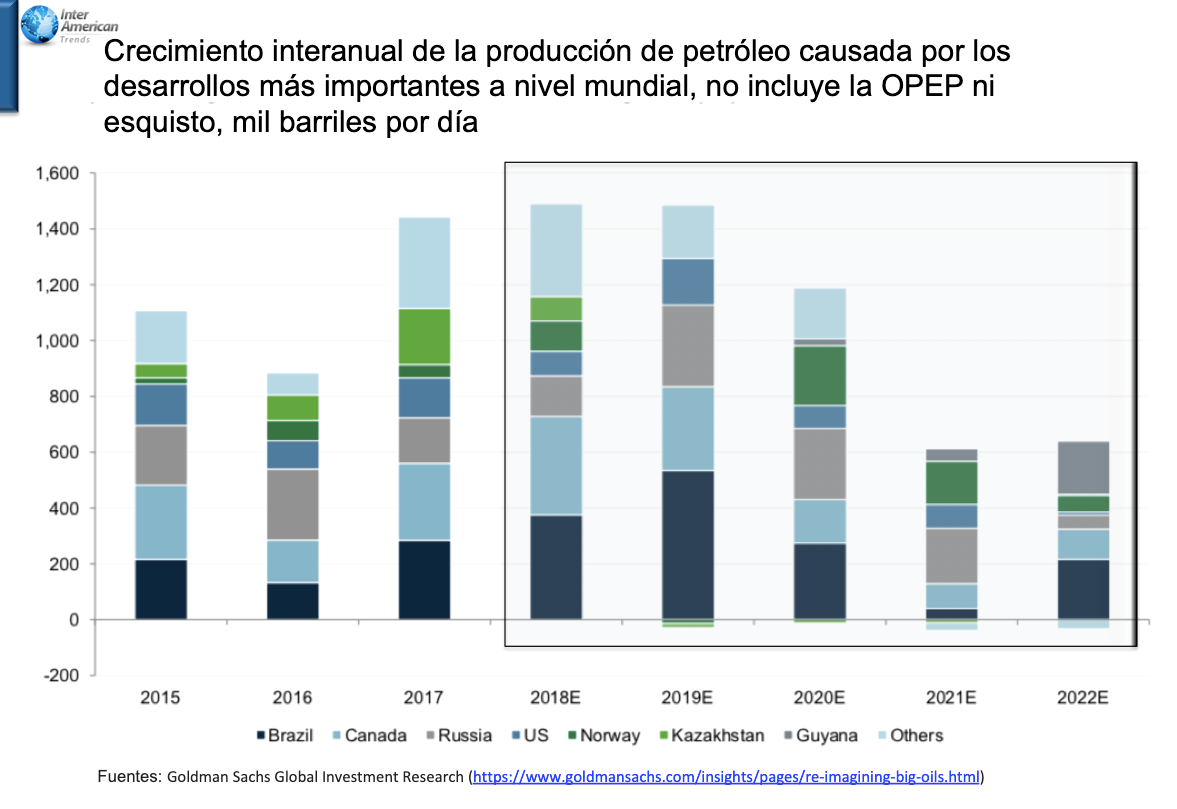

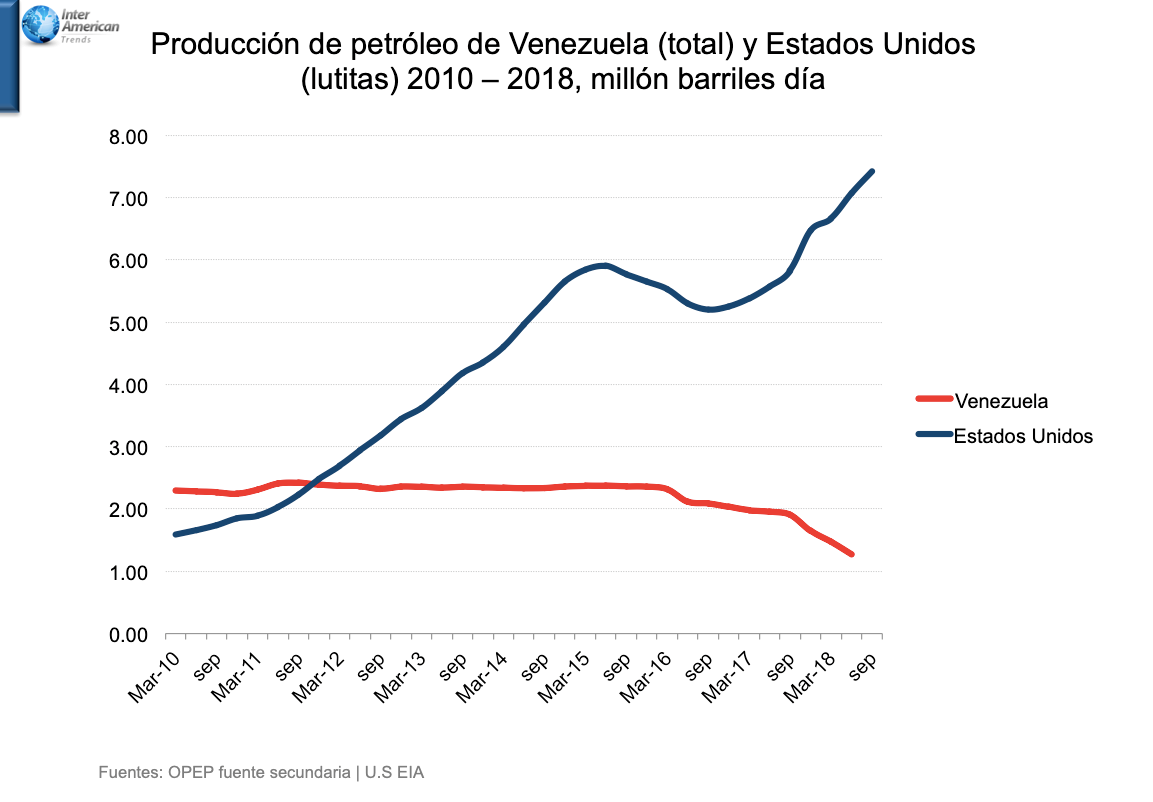

PDVSA, Venezuela state-owned enterprise, is at the dawn of death as the industry of Venezuela -as it used to be called. The death certificate will state that the cause of its death is bankruptcy. An estimated debt of more than 85 billion dollars, between corporate bonds and liabilities with service contractors, partners in the mixed company joint venture, and the Chinese Fund, plus the accelerated fall of production of 700 thousand barrels per day only this year, and 1.1 million barrels per day since 2014, have led to the bankruptcy of PDVSA. The assets that PDVSA currently has barely met all its debts, including the one it has with the Central Bank of Venezuela, that has been financing its operation in bolívares for the past eight years. The first to declare PDVSA's brain death was the president of the oil commission of the National Constituent Assembly, David Paravisini, who proposed replacing the state oil company with an energy corporation to evade PDVSA's financial commitments and debts. With this, all of PDVSA's debt will stay in the old company: debts with bondholders, joint venture partners, suppliers and other creditors - something unacceptable to the international community that would be seen this action as a fraud. The proposition of the constituent parliamentarian Paravisini uncovered that PDVSA does not have the money to face its debts, although now he says that was an "academic proposal". On the other hand, the federal judge of Delaware in the United States, Leonard P. Stark, considered PDVSA an alter ego of Venezuela, so the shares of its subsidiary in the United States, Citgo, could be auctioned to honor the debt of 1.4 billion dollars, product of the lawsuit of Canadian company Crystallex against the Venezuelan government. This decision would be taken on December 20th and would cause the sudden death of PDVSA. Citgo is the PDVSA subsidiary that guarantees the payment of the shipments of 110 thousand barrels per day of light crude oil from the United States to the Caribbean islands of Bonaire and St. Eustatius, to be mixed with the heavy crude oil of the Orinoco Oil Belt and then subsequently export to China as payments of the Chinese Fund. Additionally, Citgo guarantees the supply of 110 thousand barrels per day of petroleum products (gasoline components, naphtha, oils, diesel, natural gas liquids) to Venezuela's refineries. More to PDVSA's doom, the extra-heavy crude oil from the oil sands of the Orinoco Oil Belt - the world's largest reserves – are not having and will not have an impact in production growth. According to Rafael Ramirez, former president of PDVSA during the presidency of Hugo Chávez 2004-20014, the Belt is pumping 700 thousand barrels per day, 600 thousand barrels per day less than in his administration. This reduction indicates that conventional crude oil from Zulia state and that from the eastern part of Venezuela barely reach 400 thousand barrels per day, representing an exponential oil production decline of 25% to 30% annually. For what is coming, when evaluating the investment projects of large oil companies, Venezuela does not appear on the horizon of the global oil industry for the next two years. The capital expenditure of these companies is mainly oriented towards the reservoir's development in Brazil, Russia, the United States, Kazakhstan, and Guyana, and in the oil sands of Canada, according to the research division of Goldman Sachs. In five years, it will be more difficult to finance projects in the Orinoco Oil Belt due to the environmental impact regarding carbon footprint. This effect will make the tar sands one of the last sources of energy to develop. The investment opportunity that oil sands represented twenty years ago will be margin after 2022. The new energy developments will increasingly focus on gas, natural gas liquids, and renewable sources. When evaluating the way in which PDVSA and the United States fracking industry approached their competitive advantages to increase production of unconventional hydrocarbons, totally opposed developments are observed. While Venezuela lost its leadership in the world oil sector, the United States became one of the leading oil producers globally. Both technological developments, the extra-heavy oil from the oil sands of the Orinoco in Venezuela and the shale oil from Texas and Dakota in the United States, faced the same challenges of the oil prices, forcing PDVSA and the fracking industry to develop a capacity to adapting the oil market. The results are that the United States is going through a cycle of oil bonanza, while Venezuela is going through a period of agony that will lead to the end of PDVSA as the industry, even when Venezuela produced more oil than the United States fracking between 2010 and 2011. Finally, the end of PDVSA will be accelerated if the Trump administration decides to impose new sanctions against the government of Nicolas Maduro -secondary sanctions. Aimed at prohibiting international companies from doing business with the Venezuelan regime that includes the possibility of an embargo of petroleum products and spare parts essential for oil and petroleum products production. |